How To Create A B2B Ideal Customer Profile

- Kirk Enright

- Feb 2, 2024

- 7 min read

Ideal Customer Profiles are a simple, powerful way for sales and marketing teams to better understand, engage and impact their customers. They can help you set priorities, allocate resources, uncover gaps and put the spotlight on new opportunities, but more important than that is the way they get everyone on the same page, moving in the same direction, trying to reach the same destination.

Even though different teams use different tools and tactics, ICPs help to ensure that all those individual efforts are complimentary, not competing.

What is an Ideal Customer Profile?

An ICP is a composite that uses high-level firmagraphic, demographic and/or psychographic data to help you paint a richly-detailed picture your target audience. Developing ICPs is part art, part science — the art is how you define and differentiate your ICPs; the science is all the traits, tendencies and characteristics that are commonly associated with these types of people. When done correctly, ICPs help you understand not only who your customers are, but how to engage them.

What are the benefits of Ideal Customer Profiles?

Whether created for B2B, B2C or DTC, ICPs provide three powerful benefits:

Focus

Alignment

Direction

This is true regardless of company size or growth stage:

startups benefit because they know who to target and how to target them

scale-ups get more consistency and predictability from their established sales and marketing process

large, well-established organizations benefit because even the best companies get complacent and periodically need to re-think who and how they target buyers

What are “best practices” for developing Ideal Customer Profiles?

While there are a seemingly infinite number of ways to develop ICPs (each with their own advocates and detractors), to be truly useful, they should always reflect the following:

Represent the most valuable segments of your customer base (as defined by conversion rate, deal size, usage rate, upsell rate, etc.)

Be developed from a solid combination of research, direct observations and experiences, and individual expertise

Be organized around a framework that is directly related to your produce or service, like use cases, pain points, journey maps, buying triggers, jobs-to-be-done, lifestyle choices, life stages, professional affiliations, etc.

Be realistic

Include personal and professional characteristics that facilitate empathy and understanding, like needs, drives, priorities, pain points, KPIs, etc.

How long does it take to create Ideal Customer Profiles?

It really depends on you.

If you’re committing to formal research that will include customer surveys, focus groups, one-on-ones, etc., then you’re likely to spend two or three months collecting and analyzing data, segmenting your customer base, and mapping your findings to individual ICPs.

On the other hand, when formal research isn’t an option, you can usually develop actionable ICPs from personal observations and experiences in just a few hours.

The key is to leverage whatever customer knowledge you can get, whether it’s coming from professional researcher or an afternoon white-boarding session with your team.

What’s the difference between a Buyer Persona and an Ideal Customer Profile?

Ideal Customer Profiles (ICPs) are a subset of B2B buyer personas. They are composites that represent your most valuable customers, either because they are profitable, easy to convert, or satisfy some other key internal criteria.

The process of creating ICPs is similar to the process of creating buyer personas, though ICPs sometimes include less personal information and more industry-specific information, especially when they are used in conjunction with an Account-based Marketing (ABM) approach.

How do I create an Ideal Customer Profile?

ICPs start with a solid understanding of the people buying your products and/or services. For most companies, this means some combination of customer surveys, internal and external focus groups, round tables, one-on-ones, clickstream data, web tracking, industry observations, competitor analysis, personal experience/expertise, anecdotal information, best practices, and hunches/“gut” instincts.

Once you’ve finished gathering your data, the first step is to consolidate everything so you can get a good, overall picture of your customer base.

How do I consolidate my research?

It really depends on what data you have to work with.

If you did formal research, you’ll probably have charts, graphs, tables and a written summary from your research team, as well as a few spreadsheets full of means, medians, ranges, quartiles, k-means clusters, etc..

If you did your research on your own, it probably means you’ll have iPhone pics of your whiteboarding sessions.

In either case, the idea is to map out what you know about your customers, especially details about who they are, why, when and how they buy, and anything else that’s directly relevant to your product or service.

Like any map, your scale isn’t ever going to be 1:1, but should include enough detail so you can create segments that reflect relevant details — i.e. industry, company type, company size, job titles or occupational classes, seniority, technologies, professional associations, etc.

What should I do after I’ve consolidated my customer research?

Once you’ve mapped out your customers, creating ICPs is really just a simple, three-step process:

Create an organizational framework for your ICPs

Use this framework to sort your customers into meaningful groups

Identify the underlying firmagraphic, demographic and/or psychographic attributes each group you’ve identified has in common

Step 1: creating an organizational framework for your ICPs

Customers can be segmented in a variety of different ways. The key is to use an organizational framework that is specific to your business. In most cases, this means building a framework around one of the following scenarios:

Once you’ve chosen the scenario that’s best-suited to your business, identify three to five unique, underlying criteria. These criteria are what you’ll use to sort and filter your customers into meaningful groups.

(For more details on choosing the right framework, see “A Brief Guide To Buyer Persona & ICP Frameworks,” also available as a free download.)

Step 2: using your framework to sort your customers into meaningful groups

Once you’ve settled on your organizational framework, you can use it to sort your customers into different groups based on which criteria they meet.

Keep in mind that even under the best of circumstances, this can be a challenge — sometimes you have to make strategic assumptions, take educated guesses, or work through multiple iterations before you finalize who goes where and why.

(You can find worksheets for individual frameworks here.)

If you find that you just can’t sort all your customers into distinct groups, you may have to rework your framework and/or the underlying criteria.

Step 3: identifying underlying firmagraphic, demographic and/or psychographic attributes

Once you’ve sorted your customers into distinct groups, you need to come up with a unique set of characteristics that helps you differentiate one group from another.

Most people start with firmagraphic data:

Industry

Company Size

Company Type

Region

Sometimes firmagraphic data alone establishes clear distinctions between groups; other times, this information is less useful because it’s the same for everyone.

In either case, the next thing is to identify individual job titles and/or occupational categories.

Job titles and/or occupational categories are critical because they connect you directly to priorities, pain points and KPIs, which are the foundation for effective sales pitches, content marketing strategies, demos, features, etc.

In some cases, other characteristics are relevant, too, depending on what you’re selling and why your customer are buying it. These might include:

Technology Needs

Professional Achievements and/or Milestones

Seniority

Professional Lifestyle Choices

Key Personality Traits — e.g. innovative, frugal, social, mindful, conscientious, etc.

Buying Committee role

Etc.

Like sorting customers into distinct groups based on your framework criteria, identifying unique sets of characteristics can mean making assumptions, taking educated guesses and/or working and re-working your choices.

One trick is to look for patterns.

What qualities do members of each group have in common? Do they the share key firmographics? Key demographics? Key psychographics? Are any of these characteristics unique? Can they be used to differentiate members of this group from the others?

Another trick is to look for “lowest common denominators” — unique (but not too unique), high-level characteristics that are shared by everyone within a given group.

This can also take a bit of effort before you arrive at a suitable list of commonalities, but tends to yield good results.

Once you have identified the unique, descriptive characteristics common to each group, you’re ready to create your individual ICPs.

Putting it all together

Having identified key demographic and psychographic descriptors for each group, the last thing to do is condense and consolidate this information to create individual ICPs.

This is usually a pretty straightforward process: keep what’s most unique, meaningful and/or representative, and get rid of what’s not.

If you have a few job titles descriptors that are similar, you’ll want to combine them; if you end up with more than one unique set of descriptors for any given group, you’ll want to split them apart by either creating an additional ICP for that group or going back and creating an additional group.

When you’re done you should have individual sets of descriptors that reflect your framework and represent the composite characteristics of your key customer groups.

While you could just give your team a list of the descriptive characteristics associated with each ICP, a few simple additions can make this information more accessible.

Start by giving each ICP a unique name that relates back to your organizing framework — e.g. High-Volume Travel Agent, CTO, Blocker, Fashion Designer, Freelance SEO Copywriter, etc. Then include a brief bio or professional summary that will help you and your team understand and empathize with this prospect.

It’s important to take some time to detail pain points, priorities, and KPIs, too, so you can tailer your sales and marketing efforts to their needs.

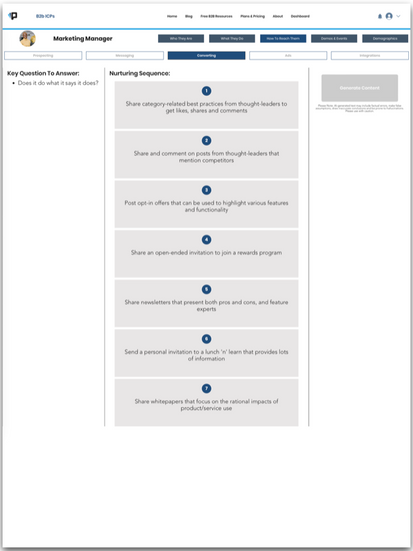

You can also go deeper to include social media habits, interaction styles, engagement needs, narrative preferences and a host of other details that can be invaluable when it comes to pitching, creating content and collateral, deciding what kinds of events to hold, and doing demos.

Once you’ve completed the process and packaged up your ICPs, you have an essential tool you can share with sales, marketing, design & development, customer success, and anyone else on your team that wants to understand who you’re trying to engage and how best to engage them.

Comments